Our Story

At Xupes, we believe that luxury is more than just a product—it's a story. Founded in 2009, Xupes set out to redefine the way people experience luxury by proving that pre-loved items could be just as desirable as new. Today, we are proud to be a leader in the global pre-loved luxury market, offering an exceptional range of meticulously authenticated jewellery, handbags, and accessories. Our commitment to quality, sustainability, and trust has earned us a reputation for excellence, and our passion continues to drive us as we shape the future of luxury resale

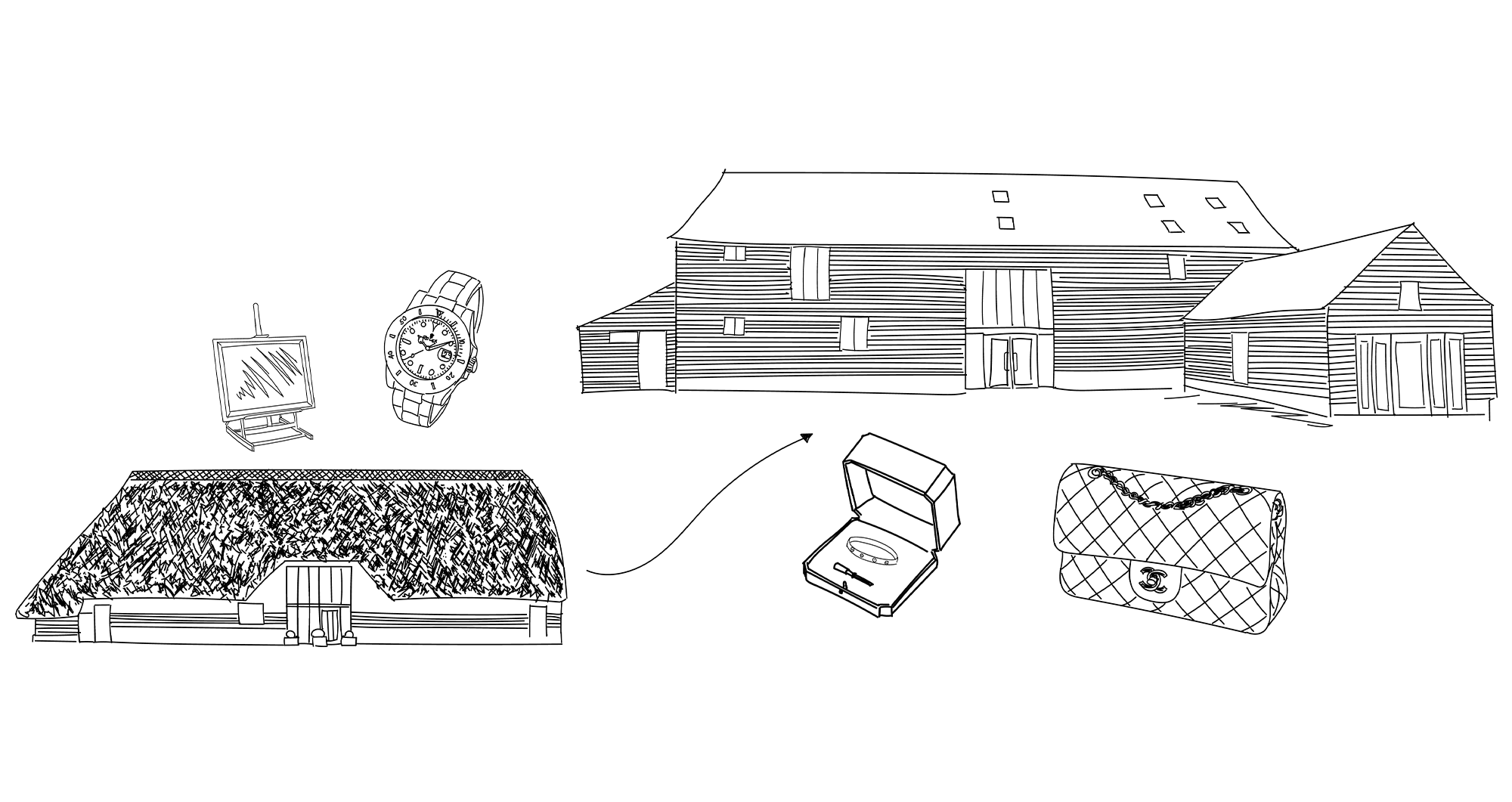

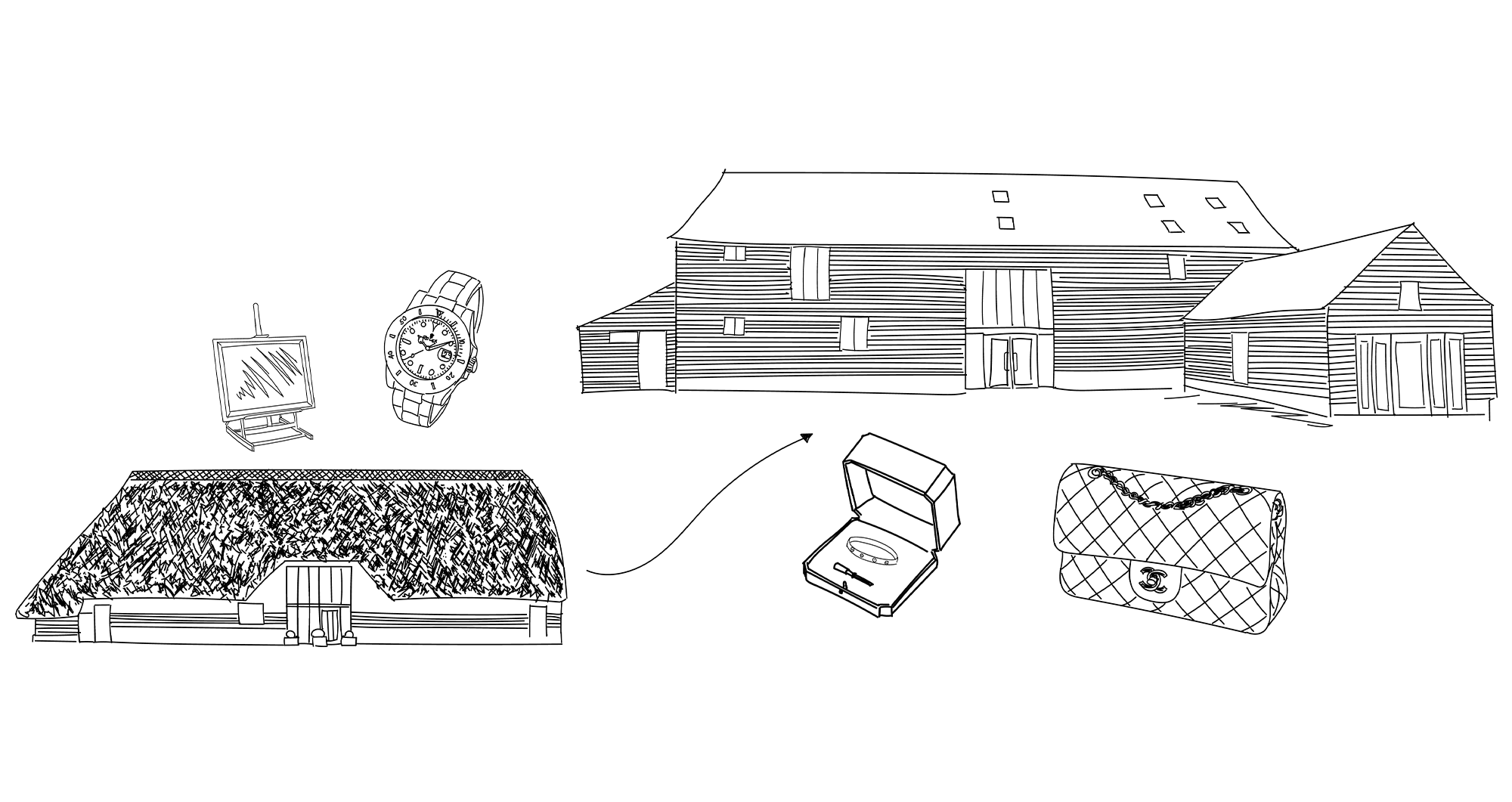

Xupes was born from a vision to make luxury more accessible, sustainable, and timeless. It all began in a family home in Hertfordshire in 2009, where our founders curated a small selection of pre-loved luxury items, starting with watches, art, and design pieces. From the very beginning, we saw the potential for pre-loved goods to hold beauty, value, and craftsmanship that transcend time.

As the world slowly embraced the idea of second-hand luxury, Xupes stood out by focusing on quality and provenance. We expanded our offerings to include jewellery, handbags, and accessories from some of the world’s most prestigious brands which later became our sole focus, all while maintaining rigorous standards of authenticity. What started as a niche offering has grown into a global marketplace, where iconic pieces find new homes, and the stories behind them live on.

The Xupes Experience

At Xupes, we don’t just offer luxury items—we create a truly bespoke experience for each and every client. Whether you’re shopping online or visiting us in person, our dedicated team of specialists is there to guide you through every step of the journey. We understand that buying a pre-loved luxury item is a highly personal decision, and we are committed to ensuring that every interaction with Xupes feels seamless, rewarding, and tailored to your needs.

Our commitment to authenticity is at the heart of everything we do. Each item is rigorously inspected and authenticated by our in-house experts before being offered to our clients, so you can purchase with complete confidence. The Xupes Promise, paired with our industry-leading 30-day return policy, ensures that every transaction is underpinned by trust and transparency. Our team’s expertise, combined with our dedication to exceptional service, means that we don’t just sell products—we build relationships.

Milestones & Media Recognition

Over the past 15 years, Xupes has reached significant milestones that have solidified our reputation as a leader in the pre-loved luxury market. Our journey has been marked by continuous innovation and dedication to our clients, and this has been recognised by the wider public through various media features.

In 2020, Xupes was featured in Channel 4’s hit series, Second-Hand for 50 Grand, which offered viewers a rare behind-the-scenes glimpse into our business. The documentary showcased our meticulous process of sourcing, authenticating, and curating luxury items, bringing our story to a broader audience. This exposure further cemented our position as a trusted name in the industry.

We’ve also partnered with prominent influencers like Kate Hutchins, Fleur De Force, Kat Farmer and more, whose endorsements have helped introduce Xupes to new, engaged audiences. Our dedication to excellence has been highlighted in prestigious publications like Harper’s Bazaar, Glamour and The Times, further enhancing our visibility and influence in the world of luxury resale.

A significant milestone came in 2022 with the launch of Accessories as a main department, spearheaded by Debra Willis and Reece Morgan. This carefully curated selection of small leather goods and iconic accessories from leading luxury brands further expanded our offering, allowing our clients even more ways to experience timeless luxury.

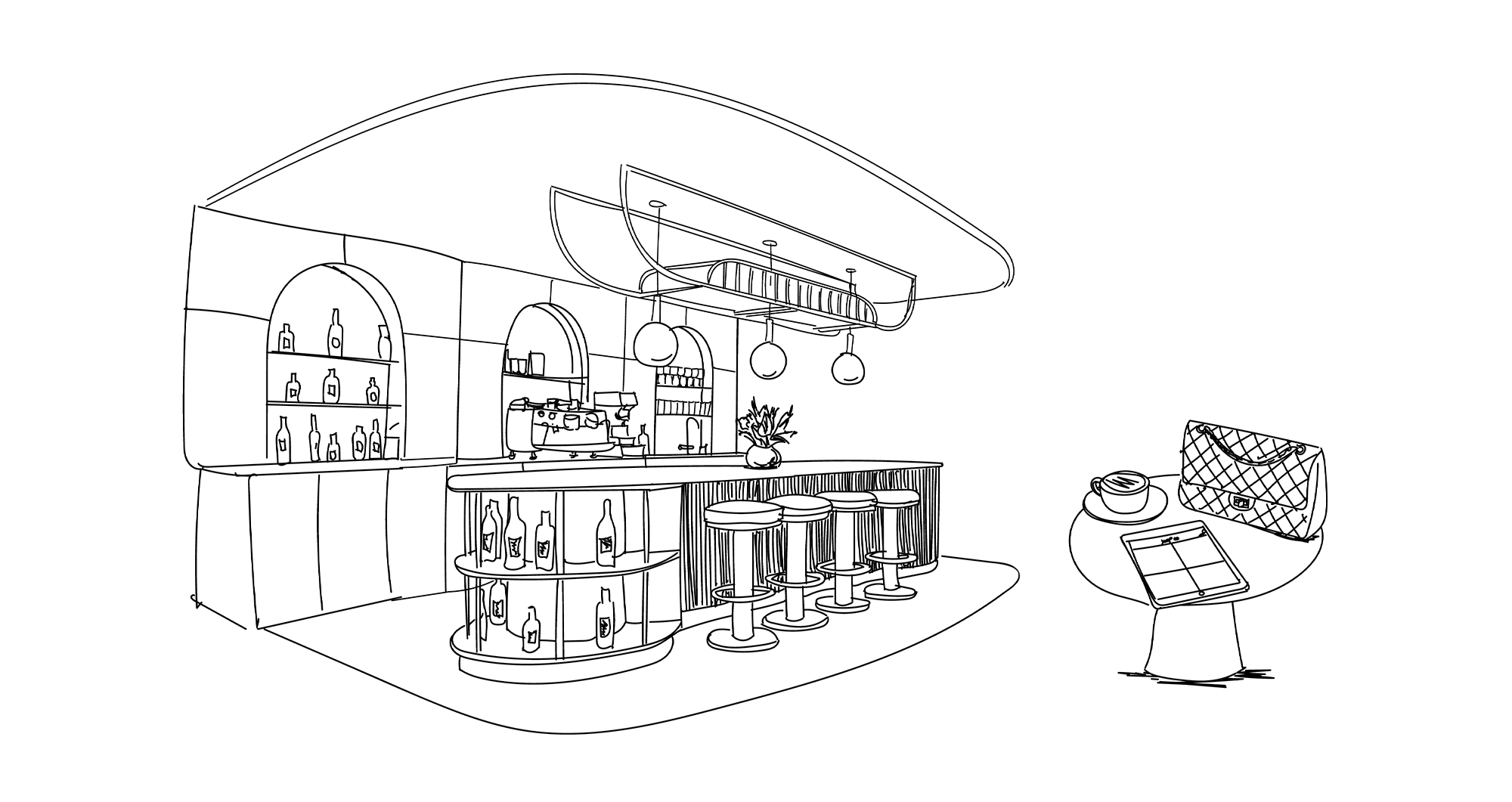

In 2023, we took an exciting step forward by opening our first physical retail space outside Hertfordshire: a concession at Sandersons Boutique Department Store in Sheffield. We later expanded into their Stroud location as well. This growth allowed us to bring the Xupes experience to new regions, offering in-person luxury shopping while maintaining the impeccable standards for which we are renowned online.

Leadership & Vision

Xupes’ success and evolution are guided by the vision and expertise of Reece Morgan and Debra Willis, two leaders with deep roots in the luxury industry. Reece, who built Xupes' handbag department from the ground up, brings a unique perspective on design and an unwavering commitment to quality. His keen eye ensures that each piece in our collection reflects the highest standards of craftsmanship.

Debra, with over 25 years of experience in retail and an extensive background in jewellery, plays a pivotal role in shaping our curated collections. Her passion for luxury and her dedication to authenticity have been instrumental in elevating Xupes’ offerings, making our selection truly timeless.

Together, Reece and Debra are driving Xupes into its next exciting chapter, ensuring that the brand continues to thrive in a rapidly evolving luxury landscape. Under their leadership, Xupes remains committed to innovation, sustainability, and delivering an exceptional client experience.

Commitment to Sustainability

At Xupes, we believe that luxury and sustainability go hand in hand. Our mission has always been to extend the life cycle of beautifully crafted luxury items, creating a more circular economy for fashion and design. By offering pre-loved luxury, we empower our clients to make conscious choices, reducing their environmental impact without compromising on style or quality.

Our ethos, “buy less, buy better,” reflects a deep commitment to sustainability. Each piece we curate not only preserves the craftsmanship and artistry of its original creation but also contributes to reducing waste. By choosing pre-loved luxury, our clients can enjoy iconic items while playing a part in a more responsible future.

The Future of Xupes

Xupes looks to the future with excitement and optimism. Our commitment to quality, authenticity, and sustainability remains at the core of everything we do, and we continue to innovate and push the boundaries of what luxury resale can offer.

Under the leadership of Reece and Debra, we’re expanding our global presence while staying true to our roots. Our focus on curating the finest selection of pre-loved luxury handbags, jewellery, and accessories ensures that we offer a timeless, elegant experience for every client. As the world becomes more conscious of sustainability, Xupes is proud to lead the way in promoting a more responsible way to enjoy luxury.

Looking ahead, we’re excited to continue writing new chapters in the Xupes story—always with an eye on creating a sustainable, accessible, and authentic future for the luxury market.